Artificial Intelligence (AI) has become a buzzword in the accounting industry in recent years. AI-powered systems can automate mundane and repetitive tasks, streamline financial processes, enhance accuracy, and provide valuable insights.

However, the integration of AI technologies in accounting also has its downsides, such as ethical issues, data security threats, and the introduction of biases. In this article, we will explore the advantages and disadvantages of artificial intelligence in accounting.

--Advertisement--

Advantages of Artificial Intelligence in Accounting

Artificial Intelligence (AI) has revolutionized the accounting industry by streamlining financial processes, enhancing accuracy, automating tasks, and gaining valuable insights.

AI has the capacity to completely transform how decisions are made financially, prognostication, and even business operations as a whole.

AI can detect previously hidden correlations and insights from a variety of data sources quickly, allowing for more precise financial reporting with lower associated costs. We will explore the advantages of artificial intelligence in accounting.

1. Enhanced Accuracy and Error Reduction

Artificial Intelligence (AI) has revolutionized the accounting industry by enhancing accuracy and reducing errors. AI-powered accounting software can analyze large volumes of financial data with greater accuracy and speed than humans.

This reduces the likelihood of errors and ensures that financial statements are accurate and reliable. AI can also identify patterns and trends in financial data that may be difficult for humans to detect. This can help accountants make more informed decisions and provide better financial advice to their clients.

Additionally, AI can automate routine tasks such as data entry and reconciliation, freeing up accountants to focus on more complex tasks that require human expertise.

The enhanced accuracy and error reduction provided by AI can help accountants provide better service to their clients and improve the efficiency of their operations.

2. Automated Data Entry and Bookkeeping

Automated data entry and bookkeeping are two of the most significant benefits of accounting automation.

Automated data entry solutions can copy data from one sheet to the next, identify discrepancies and missing information, and remove as much data entry as possible.

Automated bookkeeping, on the other hand, can pull transaction data from bank and credit card accounts and instantly record it in accounting software, ensuring that data is organized and stored securely on the cloud or on on-premises data centers.

By handling tedious, time-consuming tasks, automation frees up accountants to provide financial advice, projections, and analysis.

With accurate, up-to-date data on hand, accountants can be the trusted, impactful business partners their companies need.

3. Streamlined Financial Analysis and Reporting

Streamlined Financial Analysis and Reporting is one of the benefits of Artificial Intelligence (AI) in accounting and finance.

AI can analyze large volumes of data and identify patterns and insights quickly, allowing for more precise financial reporting with lower associated costs.

This will lead to greater efficiency and accuracy for financial reporting while reducing costs associated with traditional methods of analysis.

AI can automate various processes, analyze financial data, generate reports, and identify patterns and anomalies that suggest accounting fraud.

These services can help businesses save money and improve their financial reports’ accuracy and timeliness.

AI in accounting can help improve accuracy and efficiency, reduce costs, and provide valuable insights and predictions for decision-making.

With the increased adoption of AI, the role of accountants will evolve to focus on strategic decision-making and value-added services.

4. Improved Fraud Detection and Prevention

Improved fraud detection and prevention is one of the most significant advantages of artificial intelligence (AI) in accounting.

AI-powered systems can analyze vast amounts of financial data and identify patterns that may indicate fraudulent activities.

These systems can also detect anomalies in financial transactions, such as unusual spending patterns or suspicious transactions, and alert accountants or auditors to investigate further.

Additionally, AI can help prevent fraud by implementing automated controls and monitoring systems that can flag potential fraudulent activities in real-time.

By leveraging AI technology, accounting firms can significantly reduce the risk of fraud and protect their client’s financial interests.

5. Efficient Invoice Processing and Payments

Efficient invoice processing and payments are crucial for the smooth functioning of any business. The use of artificial intelligence in accounting has revolutionized the way invoices are processed and payments are made.

AI-powered software can extract relevant information from invoices and automatically enter it into accounting systems, reducing the need for manual data entry.

This not only saves time but also reduces the risk of errors. AI can also help in identifying fraudulent invoices and prevent payment of such invoices.

Additionally, AI-powered payment systems can automate the payment process, ensuring timely payments and reducing the need for manual intervention.

The use of AI in invoice processing and payments can significantly improve the efficiency and accuracy of accounting processes.

6. Cost Reduction and Resource Optimization

Cost reduction and resource optimization are two significant benefits of Artificial Intelligence (AI) in accounting. AI can help identify cost-saving opportunities and optimize resource allocation, leading to lower operational costs.

Automation minimizes the need for manual labor, reduces paper-based processes, and lowers the risk of errors. By automating labor-intensive tasks, businesses can significantly cut operational costs.

Implementing RPA in accounting can result in significant cost savings for organizations. Additionally, RPA allows for resource optimization, as employees can be reallocated to more strategic roles.

Accountants can redirect their efforts toward analyzing data, generating insights, and providing strategic recommendations, leading to better decision-making and improved business outcomes.

7. Real-Time Financial Insights and Forecasting

Real-Time Financial Insights and Forecasting is one of the key benefits of Artificial Intelligence (AI) in accounting and finance.

AI can quickly identify patterns in large datasets, and detect previously hidden correlations and insights from a variety of data sources quickly, allowing for more precise financial reporting with lower associated costs.

This will lead to greater efficiency and accuracy for financial reporting while reducing costs associated with traditional methods of analysis.

AI can also automate various processes, analyze financial data, generate reports, and identify patterns and anomalies that suggest accounting fraud, which can help businesses save money and improve their financial reports’ accuracy and timeliness.

With AI, accountants can gain deeper insights into financial patterns and trends, streamline financial processes, enhance accuracy, automate tasks, and gain valuable insights.

As technology advances, AI systems will become even more sophisticated and enable accountants to automate complex tasks, enhance predictive capabilities, and provide advanced financial insights.

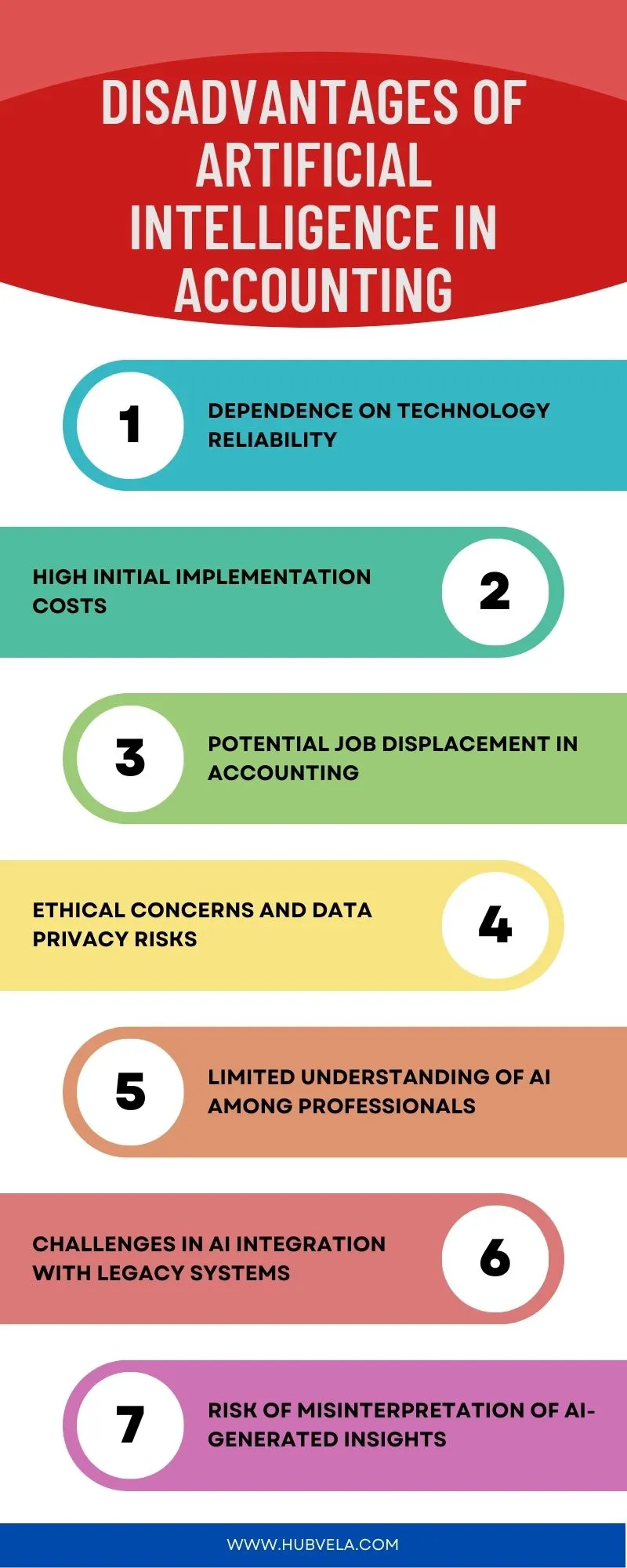

Disadvantages of Artificial Intelligence in Accounting

Artificial Intelligence (AI) has been increasingly employed in accounting processes in recent years. While AI has the potential to streamline many labor-intensive activities within a firm’s accounting process, there are still some real disadvantages associated with using AI in Accounting.

We will discuss the disadvantages of artificial intelligence in accounting.

1. Dependence on Technology Reliability

The dependence on technology reliability is a significant disadvantage of artificial intelligence in accounting. While AI can automate many accounting tasks, it is not infallible and can make mistakes.

If the technology fails or malfunctions, it can cause significant problems for businesses that rely on it. Additionally, the reliance on AI can lead to a lack of human oversight, which can result in errors going unnoticed.

This can be particularly problematic in the accounting field, where accuracy is crucial. Therefore, it is essential to recognize the limitations of AI and ensure that there are proper checks and balances in place to mitigate the risks associated with its use.

2. High Initial Implementation Costs

One of the main disadvantages of implementing artificial intelligence (AI) in accounting is the high initial implementation costs.

According to a report by Deloitte, the cost of implementing AI in accounting can range from tens of thousands to millions of dollars, depending on the size and complexity of the organization.

This includes the cost of acquiring the necessary hardware and software, as well as the cost of training employees to use the new technology.

Additionally, there may be ongoing maintenance and upgrade costs to keep the AI system up-to-date and functioning properly.

While the long-term benefits of AI in accounting can be significant, the high initial costs can be a barrier for many organizations, particularly smaller ones with limited resources.

3. Potential Job Displacement in Accounting

The rise of AI in accounting has brought about numerous benefits, including improved efficiency, increased audit quality, and the ability to analyze large amounts of data.

However, there are also challenges that come with the adoption of AI in accounting. One of the major challenges is the potential for job displacement.

As AI automates more tasks, some accountants may be out of a job. This is a concern that has been raised by many experts in the field of accounting.

The adoption of AI and automation tools into an enterprise can come with a few challenges, but none that can’t be overcome. Finance and accounting professionals need to make the shift and equip themselves with the necessary skills and knowledge.

It is important for accountants to upskill and reskill to bridge the gap in the availability of professionals with expertise in both accounting and AI.

4. Ethical Concerns and Data Privacy Risks

The use of artificial intelligence in accounting has raised ethical concerns and data privacy risks. Among the key ethical issues in data collection is the right to privacy, which allows people to limit who has access to their personal information.

The first step in using data ethically is addressing the privacy concerns that are inherent in data collection and utilization.

Data privacy (or information privacy or data protection) is about the access, use, and collection of data and the data subject’s legal right to the data.

Data security is an ethical risk issue, and good risk management means accountants should be aware of the risks and take steps to mitigate them.

Creating ethical business practices that focus on data privacy enables organizations to use data responsibly, grow revenue, build customer trust, and meet data protection compliance requirements.

It is important for organizations to articulate their own approach, consistently align values and behavior, and conduct privacy impact assessments to identify potential negative effects that the use of data might pose to particular groups.

5. Limited Understanding of AI among Professionals

While AI has immense potential to transform the accounting industry, it is still a relatively new technology, and many professionals may not fully understand its capabilities and limitations.

This lack of understanding can lead to resistance to change and reluctance to adopt new technologies.

Additionally, AI is not a replacement for human judgment and expertise, and it is important for professionals to recognize the distinction between intelligence and wisdom.

By combining the power of AI with human judgment, accountants can make informed decisions that reflect their “wisdom.”

It is crucial for accounting professionals to educate themselves on the benefits and challenges of AI in accounting and finance to stay competitive and provide more value to their clients or organizations.

6. Challenges in AI Integration with Legacy Systems

Integrating AI with legacy systems can be challenging due to the lack of interoperability between modern AI technologies and older infrastructure.

This can result in data silos, where valuable information is trapped within outdated systems, making it difficult for AI algorithms to access and analyze the data.

To overcome this issue, organizations should invest in data integration solutions that can seamlessly connect disparate systems and enable the flow of information between them.

Another challenge is the incompatibility of legacy systems with modern software and potential security risks.

Modernizing these applications by replacing them is challenging since they play a significant role in daily operations in industries such as healthcare, government, energy, and finance, where disruptions can be quite costly.

To integrate these systems, organizations can leverage robotic process automation (RPA) as a cost-effective alternative.

RPA and intelligent automation can be an alternative approach to legacy system integration and can help businesses overcome the challenges of other integration solutions.

AI-enabled RPA bots with computer vision and natural language processing (NLP) capabilities, also referred to as intelligent automation bots, can be used to integrate legacy systems.

However, ensuring that the organization’s workforce is equipped with the necessary skills and knowledge to manage the transition is also critical.

This may involve upskilling existing employees, hiring new talent with expertise in AI and data science, or partnering with external consultants who can provide support.

7. Risk of Misinterpretation of AI-Generated Insights

AI can generate insights that may be misinterpreted by humans, leading to incorrect decisions. This can happen due to several reasons such as biased data inputs, incorrect algorithms, or lack of human oversight.

The minimal human control of AI audits is another possible disadvantage. The integration of AI introduces data privacy and security risks, as any breach could lead to severe financial and reputational damage.

AI models themselves can create problems when they deliver biased results. One of the greatest challenges of AI in accounting can be access to client data.

AI-based machine learning poses several risks to data protection. The drawbacks of AI include ethical concerns about bias and privacy, security risks from hacking, and a lack of human-like creativity.

It is important to have proper oversight and controls in place to ensure that AI-generated insights are accurate and reliable.

Conclusion on Advantages and Disadvantages of Artificial Intelligence in Accounting

In conclusion, the integration of artificial intelligence in accounting has both advantages and disadvantages.

The benefits of AI in accounting include the automation of mundane and repetitive tasks, enhancing accuracy and efficiency, streamlining financial processes, and gaining valuable insights.

However, there are also potential downsides to consider, such as ethical issues, data security threats, the introduction of biases, high costs of creation, and the skills gap.

Despite these limitations, AI can still help enhance traditional labor-intensive tasks and lead to improved accuracy.

It is important to carefully consider the advantages and disadvantages of AI in accounting before implementing it in a business.