Are you curious about the advantages and disadvantages of computers in banking? Well, buckle up because we’re about to dive into this topic headfirst.

Computers in banking have become as common as a fish in the sea, revolutionizing the way financial transactions are conducted. They have brought forth a wave of improved efficiency, faster processing, and enhanced convenience for customers.

However, like everything in life, there are downsides too. Technical glitches and errors can cause headaches, while limited access for the elderly can be a challenge. And let’s not forget about the ever-present threat of cyber fraud and scams.

So, let’s explore both the positives and negatives of computers in banking, and you can decide if they’re a friend or foe in this digital age.

--Advertisement--

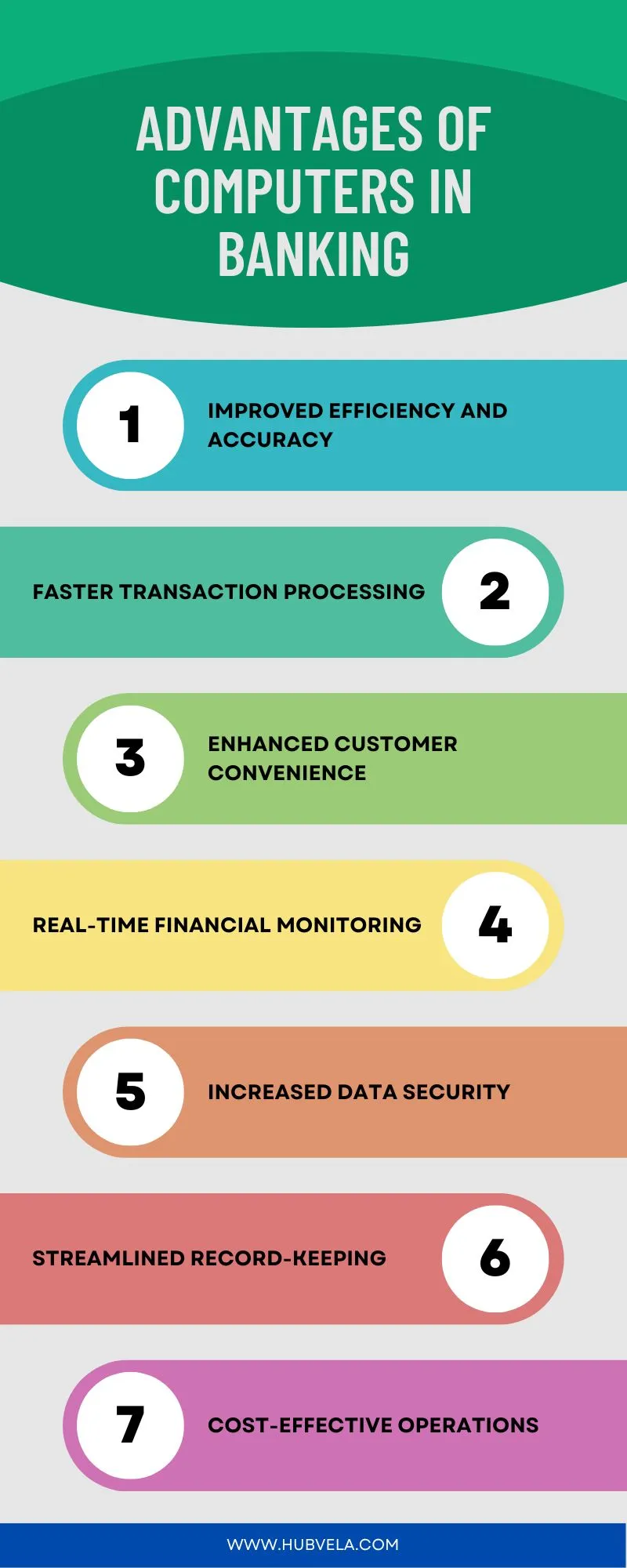

Advantages of Computers in Banking

The advent of computers in banking has revolutionized the way financial institutions operate, offering numerous advantages that have transformed the banking sector.

As technology continues to evolve, the integration of computers in banking has become increasingly essential for providing efficient, secure, and customer-centric services. Key advantages of computers in banking include:

1. Improved Efficiency and Accuracy

One major advantage of computers in banking is the significant improvement in efficiency and accuracy that they provide. With improved productivity and streamlined operations, computers automate data entry and processing, resulting in faster and more accurate transactions. This reduces errors that can occur with manual data entry and improves overall operational efficiency.

Computers in banking enable faster processing of transactions, allowing customers to access their funds more quickly and efficiently.

2. Faster Transaction Processing

With computers in banking, transactions are processed faster, allowing you to access your funds more quickly and efficiently. This faster transaction processing results in improved efficiency, as you don’t have to wait in long queues or deal with time-consuming paperwork.

Additionally, computers in banking provide enhanced convenience by allowing you to perform transactions from anywhere at any time. Real-time monitoring ensures that your transactions are processed accurately, while increased security measures protect your funds from unauthorized access.

3. Enhanced Customer Convenience

Accessing your funds and performing transactions has never been easier with the enhanced customer convenience provided by computers in banking.

The automation benefits of digital transactions allow you to manage your finances from the comfort of your own home through remote banking.

With 24/7 accessibility, you can transfer funds, pay bills, and check your account balance at any time.

This improved customer service ensures that your banking needs are met swiftly and efficiently.

4. Real-Time Financial Monitoring

You can monitor your finances in real-time with the advantages of computers in banking.

Real-time financial monitoring allows for instant access to your account information, ensuring that you have up-to-date knowledge of your financial status.

Through financial analysis and data visualization, computers can provide you with a clear and concise overview of your transactions, making it easier to track your spending and budget effectively.

Additionally, computers can utilize predictive analytics to help you make informed decisions and manage potential risks.

5. Increased Data Security

One of the advantages of computers in banking is the enhanced data security they offer. With increased efficiency, banks can protect customer data through strict protection measures and advanced cybersecurity technologies. These measures help prevent unauthorized access and ensure data privacy.

Additionally, banks utilize data backup and recovery systems to safeguard against potential cybersecurity threats. By leveraging computer technology, banks can provide customers with a secure banking experience, instilling trust and confidence in their services.

6. Streamlined Record-Keeping

To streamline record-keeping in banking, computers enable efficient and accurate management of financial transactions and customer information. The automation benefits provided by computers allow for streamlined processes and efficient transactions.

With digital documentation, banks can easily store and retrieve important records, reducing the need for physical paperwork. This not only saves time but also improves accuracy, as manual errors are minimized.

7. Cost-Effective Operations

Computers in banking offer numerous advantages. They provide cost-effective operations that streamline financial processes and improve efficiency. Through automated processes, banks can reduce expenses and allocate resources efficiently. This simplification of operations improves productivity and enhances the overall banking experience. With the help of technology, banks can optimize their operations, resulting in reduced costs and increased profitability. This cost-effective approach allows banks to deliver better services to their customers while maintaining a competitive edge in the industry.

Disadvantages of Computers in Banking

While computers have brought numerous advantages to the banking industry, such as increased efficiency, convenience, and accessibility, there are also some disadvantages associated with their use in banking.

We will discuss the disadvantages of computers in banking in detail.

1. Security Risks and Breaches

Your financial institution’s security can be compromised due to the risks and breaches associated with computer usage in banking.

While computers have improved efficiency and convenience in banking, they also pose significant security challenges.

Without proper security measures, data breaches can occur, leading to privacy concerns and potential fraud.

Therefore, effective risk management and robust fraud prevention strategies are crucial to safeguarding your financial institution and customer information.

2. Dependency on Technology

Relying heavily on technology can leave you vulnerable to potential disruptions in banking operations.

The increasing technology dependence in the banking industry, especially with the rise of online banking and digital advancements, has made financial institutions more susceptible to system failures, cyber attacks, and software glitches.

Automated processes and an intricate IT infrastructure may streamline operations, but they also introduce complexities and the risk of technical failures that could impact customer service, transactions, and overall banking functionality.

3. Lack of Personal Touch

With technology playing a major role in banking operations, it’s important to consider the lack of personal touch that arises from relying heavily on computers. While computers provide efficiency and convenience, they lack the personal interaction that customers often seek.

Building relationships and offering personalized services are crucial for customer satisfaction. The human touch is needed to understand individual needs and provide tailored solutions. Without it, banks risk losing the personal connection that fosters trust and loyalty.

4. Potential Job Loss

Computers in banking can potentially lead to job loss, as automation replaces certain tasks previously performed by bank employees. This automation impact raises concerns about job security and the economic implications of workforce displacement.

The rise of technological unemployment is a real threat in the banking industry, as more and more tasks can be efficiently and accurately performed by computers. As a result, banks may need to reevaluate their workforce needs and provide support for employees affected by these changes.

5. Technical Glitches and Errors

The technical glitches and errors in banking can be a major disadvantage of using computers. The data breaches, software malfunctions, network failures, system crashes, and user errors can lead to serious problems. These issues can result in the loss or corruption of important financial information, causing inconvenience and potential financial loss for customers.

Moreover, resolving these problems can be time-consuming and costly for both the bank and its customers. It’s crucial for banks to have robust security measures and backup systems in place to minimize the impact of such glitches and errors.

6. Limited Access for Elderly

You may find it challenging to access banking services through computers if you’re an elderly individual.

The accessibility challenges faced by the elderly include technological barriers, the digital divide, and user-friendly interfaces. Many elderly individuals may lack the necessary technological skills or have difficulty navigating online banking platforms.

Additionally, the digital divide between generations can further hinder their access to these services. Limited customer support for technical issues can also pose a problem for the elderly, making it harder for them to utilize online banking effectively.

7. Cyber Fraud and Scams

When it comes to banking online, you need to be aware of the risks associated with cyber fraud and scams.

Cybersecurity measures are in place to protect your information, but online phishing, identity theft, malware attacks, and digital fraud are still prevalent.

It’s important to be cautious when providing personal information online and to regularly monitor your accounts for any suspicious activity.

Stay informed and take necessary precautions to safeguard your financial well-being.

Conclusion on Advantages and Disadvantages of Computers in Banking

Overall, it can be concluded that computers have both advantages and disadvantages in the field of banking.

On the positive side, computers have drastically improved efficiency and accuracy in banking operations. They’ve also led to enhanced customer satisfaction by providing convenient and accessible banking services.

However, the impact on employees can’t be ignored, as it has resulted in job losses and reduced personal interaction with customers.

Furthermore, future developments in computer technology must address concerns related to cyber risks and ensure effective risk management in the banking sector.