Debt settlement can be a viable option for individuals struggling with overwhelming debt. It involves negotiating with creditors to settle a debt for less than the amount owed.

While this approach can provide relief from unmanageable financial burdens, it also comes with its own set of advantages and disadvantages.

Understanding the pros and cons of debt settlement is crucial for making an informed decision about your financial future.

In this article, we will explore the pros and cons of debt settlement, equipping you with the knowledge to assess whether it is the right choice for your circumstances.

--Advertisement--

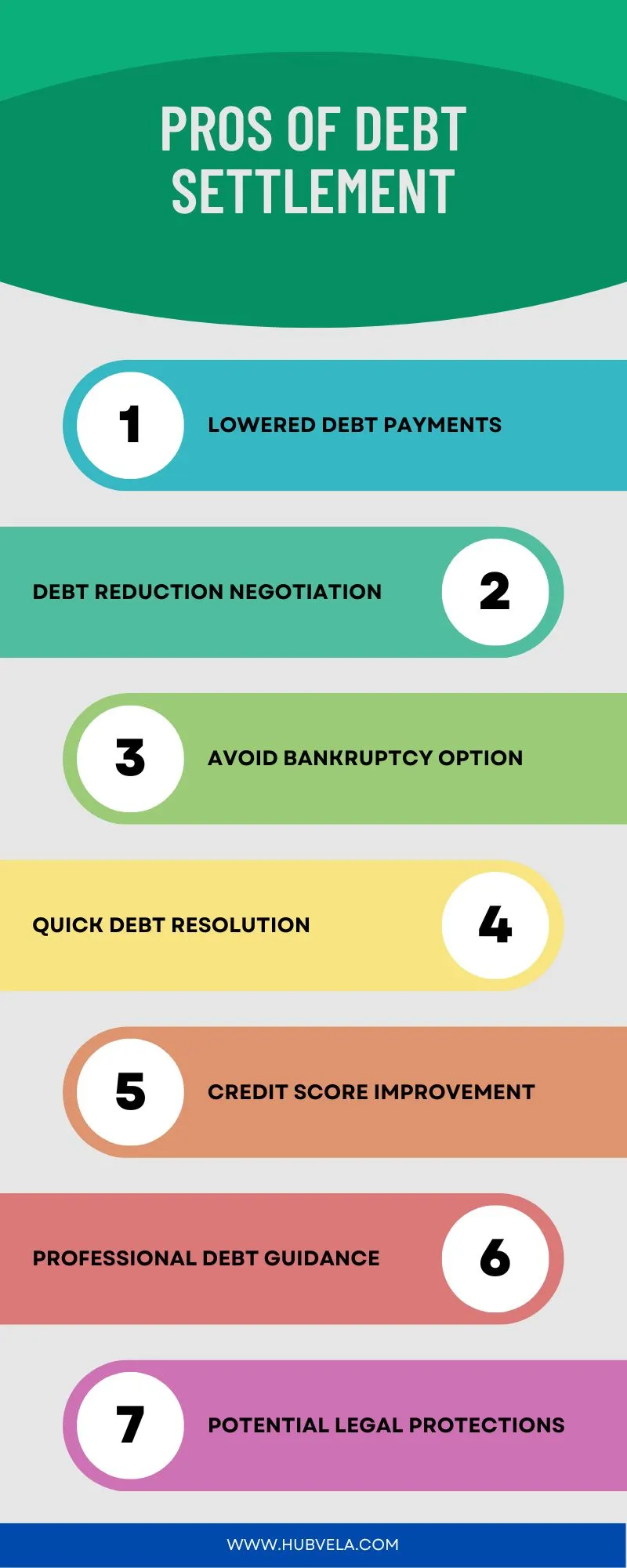

Pros of Debt Settlement

Unburdening oneself from overwhelming debt can be a challenging yet transformative journey. One effective strategy to achieve this goal is through debt settlement—a process that offers promising benefits for those seeking financial relief.

We explore the pros of debt settlement, providing valuable insights for individuals looking to regain control over their finances.

1. Lowered Debt Payments

Lowered debt payments through debt settlement can provide relief by reducing the total amount you owe to creditors. This reduction can make your monthly payments more manageable, giving you the opportunity to regain control of your finances.

By negotiating with creditors to settle your debts for less than what you owe, you can potentially save money in the long run. Lowered debt payments also mean you may be able to pay off your debts sooner than anticipated, helping you move towards a debt-free future faster.

It’s essential to consider the impact on your credit score and the potential tax implications of forgiven debt, but overall, reduced debt payments can offer significant financial breathing room.

2. Debt Reduction Negotiation

Negotiating debt reduction as part of a settlement process can provide you with several advantages in managing your financial obligations.

By engaging in debt reduction negotiations, you have the opportunity to lower the total amount you owe to creditors, making it more feasible for you to repay your debts.

This process can also help you avoid the negative consequences of defaulting on your loans, such as damaged credit scores or legal actions.

Negotiating debt reduction allows you to create a structured repayment plan that aligns with your current financial situation, giving you a clearer path to becoming debt-free.

3. Avoid Bankruptcy Option

To steer clear of bankruptcy and reap the benefits of debt settlement, consider the option of avoiding bankruptcy as it presents numerous advantages in managing your financial obligations effectively.

By opting for debt settlement instead of bankruptcy, you can negotiate with creditors to lower the total amount owed, making it more manageable to repay. This option also allows you to avoid the long-term negative impact on your credit score that bankruptcy can bring.

Debt settlement provides a quicker resolution compared to the lengthy process of bankruptcy proceedings.

It offers a more flexible approach to resolving your debts, giving you the opportunity to regain financial control without the severe consequences associated with filing for bankruptcy.

4. Quick Debt Resolution

For those dealing with overwhelming debts, quick debt resolution through debt settlement can provide a faster path to financial relief and stability. Debt settlement allows you to negotiate with creditors to pay off a portion of your debt, typically in a lump sum payment.

This process can help you get out of debt more quickly compared to making minimum payments or entering a long-term repayment plan.

By settling your debts promptly, you can avoid accruing additional interest and fees, ultimately saving you money in the long run.

Quick debt resolution also means you can move on from the stress and burden of debt sooner, allowing you to focus on rebuilding your financial health and planning for a more stable future.

5. Credit Score Improvement

If you’re looking to boost your credit score, debt settlement can offer a path to improvement by resolving outstanding debts efficiently. By negotiating with creditors to pay off your debts for less than what you owe, you can work towards clearing your financial obligations.

As you start settling your debts, your credit utilization ratio decreases, positively impacting your credit score. With each settled debt, you demonstrate responsible financial behavior, which can reflect positively on your credit report.

Over time, as more debts are settled, your credit score has the potential to gradually improve. This improvement opens up opportunities for better interest rates on loans and increased chances of approval for future credit applications.

6. Professional Debt Guidance

Seeking professional debt guidance can provide invaluable support and expertise as you navigate the debt settlement process. Debt settlement experts have the knowledge and experience to negotiate with creditors on your behalf, potentially reducing the total amount you owe.

They can also help you understand your financial situation better, create a personalized debt repayment plan, and offer advice on managing your finances more effectively.

Professional debt guidance can save you time and stress by handling negotiations and communications with creditors, allowing you to focus on rebuilding your financial health.

These experts can provide you with valuable resources and tools to help you stay on track with your debt repayment journey.

Consider seeking professional debt guidance to streamline the debt settlement process and improve your financial outlook.

7. Potential Legal Protections

How can potential legal protections enhance your debt settlement process?

Legal protections can provide you with a safety net during debt settlement negotiations. These protections can safeguard you from aggressive creditors, ensuring they follow laws and regulations.

In case of any violations or harassment, legal safeguards can offer you recourse and protection. Legal protections can help outline your rights and ensure that the debt settlement process is fair and transparent.

By having legal safeguards in place, you can feel more secure and empowered throughout the debt settlement journey. This added layer of protection can give you peace of mind and help you navigate the process with confidence.

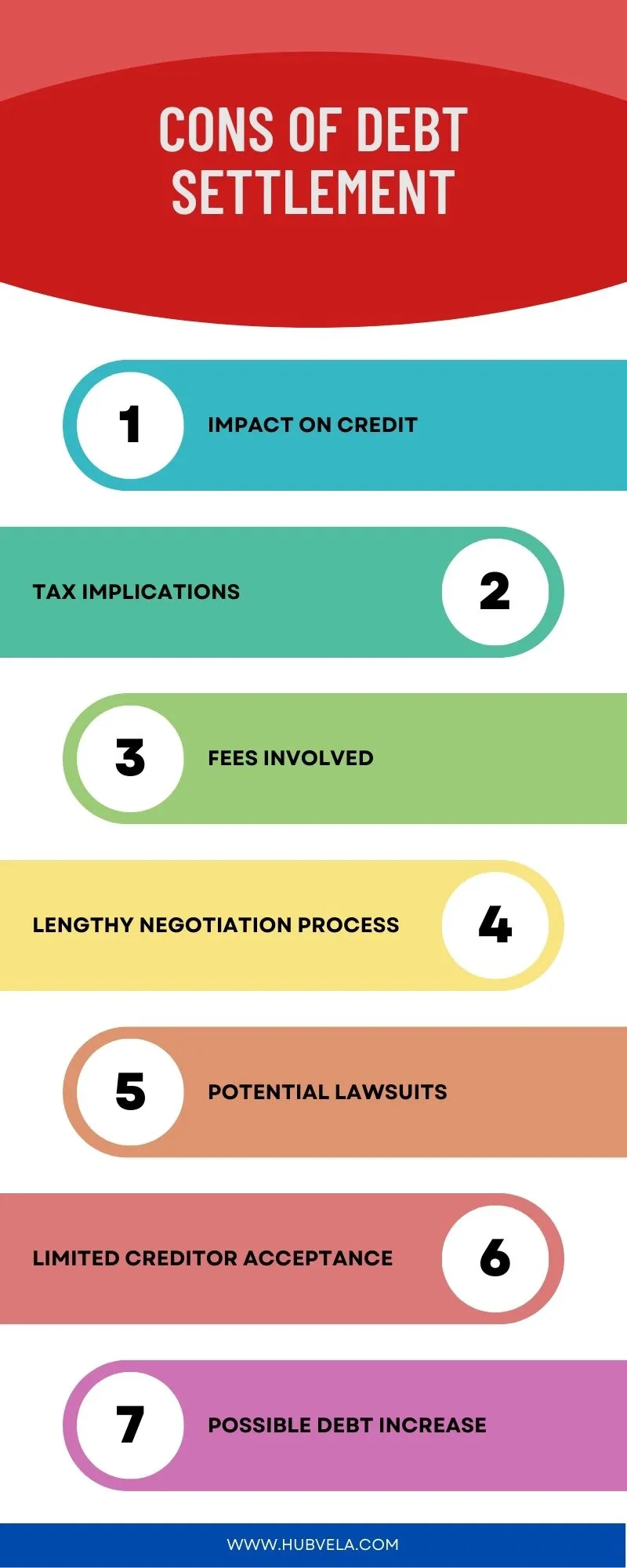

Cons Of Debt Settlement

Debt settlement has emerged as an alternative solution for individuals facing overwhelming financial burdens.

However, while this strategy may offer relief from mounting debts, it is crucial to understand its potential drawbacks before embarking upon such a path.

We explore the cons of debt settlement—a critical aspect that often goes unnoticed in the pursuit of financial freedom.

1. Impact on Credit

Experiencing a negative impact on your credit score is a significant disadvantage of debt settlement. When you opt for debt settlement, your credit score can take a hit because you aren’t paying the full amount owed.

This negative mark stays on your credit report for several years, affecting your ability to secure loans or credit cards in the future. Lenders may view you as a higher-risk borrower due to this blemish on your credit history, leading to higher interest rates or even denial of credit.

While debt settlement can help you get out of debt, it’s essential to consider the long-term consequences of your creditworthiness before making a decision.

2. Tax Implications

Unfortunately, settling your debt can have negative tax implications that you should be aware of. When a portion of your debt is forgiven through settlement, the IRS may consider that amount as taxable income.

This means you could end up owing taxes on the forgiven debt, increasing your financial burden. The creditor might send you a Form 1099-C, stating the amount forgiven, which you’d need to report on your tax return.

It’s essential to understand the potential tax consequences of debt settlement before proceeding, as it could impact your overall financial situation.

Consulting with a tax professional can help you navigate these implications and plan accordingly to avoid any surprises come tax time.

3. Fees Involved

Considering debt settlement? Be aware of the fees involved, as they can add to your financial obligations.

Debt settlement companies typically charge fees for their services, which can vary based on the company and the amount of debt being settled. These fees may include upfront fees, monthly service fees, and a percentage of the total debt enrolled in the program.

Upfront fees are paid before any debt is settled, while monthly service fees are ongoing for the duration of the program. A percentage of the total debt enrolled can be charged once a settlement is reached.

These fees can accumulate and impact the overall savings you may achieve through debt settlement, so it’s crucial to understand the fee structure before committing to a program.

4. Lengthy Negotiation Process

With the potential for fees impacting your financial situation, it’s important to be prepared for the lengthy negotiation process involved in debt settlement.

The negotiation phase can be time-consuming as it requires back-and-forth communication between you, the debt settlement company, and your creditors. This process involves discussing and agreeing on a reduced settlement amount that you can afford to pay.

Negotiations may involve multiple rounds of offers and counteroffers before reaching a final agreement. Creditors may take time to review proposals and make decisions, further prolonging the process.

This extended negotiation period can be stressful and may test your patience. However, staying persistent and committed to finding a resolution can eventually lead to a favorable outcome.

5. Potential Lawsuits

Prepare for legal action from creditors as a potential consequence of pursuing debt settlement. When you choose debt settlement, creditors may become more aggressive in their collection efforts.

They have the right to take legal action against you to recover the full amount owed. This could result in lawsuits filed against you to collect the debt.

If a creditor decides to sue you, it can lead to additional stress and expenses. Legal proceedings can be time-consuming and may require you to appear in court.

Moreover, if a judgment is made against you, it could negatively impact your credit score and result in wage garnishment.

Be aware of the potential for lawsuits when considering debt settlement as an option.

6. Limited Creditor Acceptance

When creditors have limited acceptance for debt settlement offers your ability to negotiate favorable terms may be significantly hindered, impacting the effectiveness of your debt settlement strategy.

If only a few creditors agree to settle your debts, you may still be left with a substantial amount to repay, defeating the purpose of debt settlement.

Limited creditor acceptance can prolong the negotiation process and lead to more complex dealings with the remaining creditors. This can result in a less efficient and more stressful debt settlement experience for you.

If only a portion of your creditors accept settlement offers, you may still face challenges in managing the debts that weren’t included in the settlements, potentially leading to further financial strain.

7. Possible Debt Increase

Experiencing a possible increase in debt is a significant drawback of opting for debt settlement as a solution to your financial challenges.

When you settle a debt for less than what you owe, the forgiven amount is often reported as taxable income by the IRS. This means that you may end up owing taxes on the forgiven debt, adding to your financial burden.

Since debt settlement involves negotiating to pay off a portion of your debts, the remaining balances may continue to accrue interest and fees while you work on settling them.

This can result in your overall debt amount actually increasing over time, making it harder to achieve financial stability in the long run.

Conclusion on Pros And Cons Of Debt Settlement

Overall, debt settlement can be a helpful option for individuals struggling with overwhelming debt. The pros include potentially reducing total debt owed and avoiding bankruptcy.

However, there are also cons to consider, such as potential damage to credit scores and the possibility of facing legal action from creditors.

It’s important to weigh the benefits and drawbacks carefully before deciding if debt settlement is the right choice for your financial situation.