When it comes to buying a home, there are many financing options available to potential homeowners. One popular option is an FHA loan, which is a type of mortgage that is insured by the Federal Housing Administration.

FHA loans are designed to help people with lower credit scores or smaller down payments to purchase a home. However, like any financial product, there are pros and cons to consider before deciding if an FHA loan is right for you.

In this article, we will explore the pros and cons of FHA loans to help you make an informed decision about your home financing options.

--Advertisement--

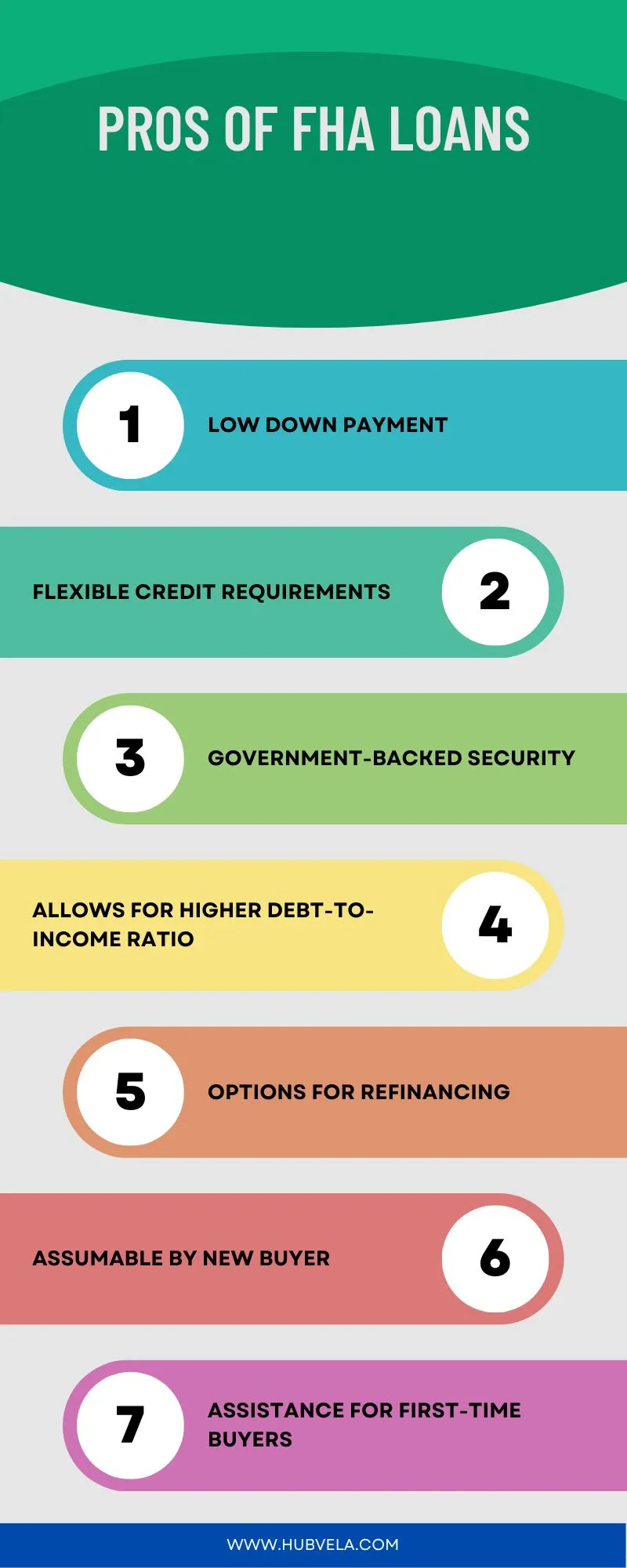

Pros Of FHA Loans

FHA loans have become increasingly popular among homebuyers in recent years, and for good reason. These loans are backed by the Federal Housing Administration and offer a range of benefits that make them an attractive option for many borrowers.

We will explore the pros of FHA loans. Whether you’re a first-time homebuyer or looking to refinance your existing mortgage, understanding the advantages of FHA loans can help you make an informed decision. So, let’s dive in and explore the benefits of this type of loan.

1. Low Down Payment

One significant advantage of FHA loans is the affordability they offer through their low down payment requirement. With an FHA loan, you can purchase a home with as little as 3.5% down, making it a great option for first-time homebuyers or those who may not have a large sum of money saved up for a down payment.

This low down payment requirement can help make homeownership more accessible and achievable for many individuals. Having a lower down payment can free up funds for other expenses or investments.

Keep in mind that while a low down payment can be advantageous, it’s essential to consider all aspects of the loan to ensure it aligns with your long-term financial goals.

2. Flexible Credit Requirements

Benefiting many potential homebuyers, FHA loans stand out for their flexible credit requirements that can make homeownership more attainable.

Unlike conventional loans that may require higher credit scores, FHA loans are more lenient, making them a viable option for individuals with less-than-perfect credit.

With an FHA loan, you may qualify with a credit score as low as 500, although a higher score can help secure a lower down payment.

FHA loans consider your overall credit history and financial situation, providing more flexibility for those who’ve experienced financial setbacks.

This flexibility in credit requirements can open doors for individuals who may not qualify for traditional mortgages, offering a path to homeownership that may otherwise be out of reach.

3. Government-Backed Security

The government-backed security of FHA loans provides a sense of stability and reassurance to potential homebuyers. Knowing that the Federal Housing Administration guarantees a portion of your loan can give you peace of mind, as it reduces the risk for lenders, making them more willing to offer favorable terms.

This backing also allows for lower down payments, making homeownership more accessible. In the event that you face financial difficulties and are unable to make your mortgage payments, the government backing can provide a safety net, potentially preventing foreclosure.

This security feature is particularly beneficial for first-time homebuyers or those with less-than-perfect credit, giving them the confidence to pursue their dream of homeownership.

4. Allows for Higher Debt-To-Income Ratio

FHA loans allow for a higher debt-to-income ratio compared to conventional loans, making it easier for you to qualify for a mortgage.

This means that a larger portion of your monthly income can go towards paying off debts and still meet the requirements for an FHA loan.

With a higher debt-to-income ratio allowance, you may be able to qualify for a larger loan amount than with a conventional mortgage. This flexibility can be particularly beneficial if you have existing debts or a lower income.

5. Options for Refinancing

Consider exploring the various options available for refinancing with an FHA loan to potentially benefit from improved terms and financial flexibility. Refinancing with an FHA loan offers the opportunity to lower your interest rate, reduce monthly payments, or even shorten the loan term.

One popular option is the FHA Streamline Refinance, which simplifies the process by requiring less documentation and allowing for a faster approval time.

If you currently have an FHA loan, you may also be eligible for a cash-out refinance, enabling you to access some of your home’s equity for other financial needs.

6. Assumable by New Buyer

To potentially benefit from the assumable feature of FHA loans, explore how this option allows a new buyer to take over your existing FHA loan terms and interest rate.

This feature can be advantageous if you have a low interest rate locked in on your FHA loan and are looking to sell your home.

By transferring the loan to the new buyer, they can inherit the favorable terms you secured, potentially making your property more attractive. This could save the new buyer money on financing costs, especially if current interest rates are higher than the rate on your FHA loan.

Assuming an existing FHA loan can streamline the home buying process for the new buyer, making it a win-win situation for both parties involved.

7. Assistance for First-Time Buyers

For first-time buyers, leveraging FHA loans can provide valuable assistance in navigating the home-buying process with more accessible financing options. FHA loans typically require lower down payments, allowing you to purchase a home with as little as 3.5% down.

This can be a significant advantage for those who may not have saved up a large sum of money for a traditional down payment. FHA loans often have lower credit score requirements compared to conventional loans, making them more attainable for individuals with less-than-perfect credit.

The FHA also offers counseling programs to help first-time buyers understand the complexities of buying a home and managing their finances effectively.

Cons Of FHA Loans

Like any financial tool, FHA loans come with their own set of advantages and disadvantages that prospective borrowers must consider before making this significant decision. Let’s discuss the cons of FHA loans.

1. Down Payment Requirements

Considering the down payment requirements for FHA loans, it’s important to understand how they may impact your home-buying process.

Unlike conventional loans that may require a higher down payment, FHA loans typically necessitate a lower down payment, often as low as 3.5% of the home’s purchase price.

While this may seem advantageous, a lower down payment means you’ll have a higher loan amount, potentially leading to higher monthly payments and increased overall interest costs over the life of the loan.

With a lower down payment, you may be required to pay mortgage insurance premiums, which can further add to your monthly expenses.

It’s essential to weigh these factors carefully to determine if the down payment requirements align with your financial goals.

2. Mortgage Insurance Premiums

Have you considered how mortgage insurance premiums impact the overall cost of an FHA loan?

Unlike conventional loans, FHA loans require both an upfront mortgage insurance premium (MIP) and an annual MIP. This additional cost can increase your monthly payments and the total amount paid over the life of the loan.

The upfront MIP is usually 1.75% of the loan amount and can be rolled into the mortgage, but the annual MIP ranges from 0.45% to 1.05% of the loan amount and is typically paid monthly.

These premiums are in place to protect the lender in case of borrower default, but they can significantly add to the expenses of an FHA loan compared to other mortgage options.

3. Property Condition Standards

Property condition standards under FHA loans can pose challenges for borrowers seeking financing for properties that require extensive repairs. The Federal Housing Administration has strict guidelines regarding the condition of the property being financed.

If the home doesn’t meet these standards, such as having peeling paint or a faulty roof, the borrower may face difficulties securing the loan.

FHA appraisers are required to assess the property thoroughly, potentially uncovering issues that could hinder the loan approval process.

This means that even if you find a home you love, it may not meet the FHA’s minimum property requirements, making it ineligible for financing through an FHA loan.

4. Limited Loan Amounts

Navigating the property condition standards under FHA loans can be challenging, and one significant drawback worth considering is the limited loan amounts available through this financing option.

With FHA loans, there are caps on how much you can borrow, which may restrict your ability to purchase higher-priced homes or properties in certain markets.

These loan limits are set by the Federal Housing Administration and can vary depending on the location of the property. If you have your eye on a more expensive home, you may find that the maximum loan amount offered through an FHA loan falls short of what you need.

It’s essential to carefully evaluate whether the loan limits align with your home-buying goals before pursuing an FHA loan.

5. Credit Score Requirements

Considering FHA loans, you may encounter a notable drawback in the form of strict credit score requirements. Unlike conventional loans that offer more flexibility with credit scores, FHA loans typically require a minimum credit score of 580 to qualify for a 3.5% down payment.

If your credit score falls below this threshold, you might face challenges in securing an FHA loan or be subject to higher interest rates.

Even if you meet the minimum credit score requirement, having a higher score can still benefit you by potentially qualifying you for better terms and lower fees.

Therefore, it’s essential to work on improving your credit score before applying for an FHA loan to increase your chances of approval and favorable loan terms.

6. Higher Interest Rates

If you have been exploring FHA loans as a potential financing option, you may encounter the downside of facing higher interest rates compared to conventional loans.

FHA loans are known for accommodating borrowers with lower credit scores or smaller down payments, but this flexibility comes at a cost.

Due to the higher risk associated with these loans, lenders often offset it by charging higher interest rates. This means that over the life of the loan, you could end up paying more in interest compared to a conventional loan.

It’s essential to carefully consider the long-term implications of these higher interest rates to ensure that an FHA loan aligns with your financial goals and capabilities.

7. Resale Restrictions

Facing higher interest rates isn’t the only drawback of FHA loans; another downside to consider is the resale restrictions that come with this type of financing.

When you buy a home using an FHA loan, you may be subject to certain limitations when you decide to sell the property.

These restrictions can include waiting periods before selling, which could potentially impact your ability to quickly move on from the property.

FHA loans may require the property to meet certain standards before it can be sold again, which could limit your pool of potential buyers. Being aware of these resale restrictions is crucial for anyone considering an FHA loan, as they can affect your future plans for the property.

Conclusion on Pros And Cons Of FHA Loans

Overall, FHA loans can be a great option for those who may not qualify for a conventional loan. The lower down payment requirement and flexible credit score requirements make homeownership more accessible for many individuals.

However, it’s important to consider the higher mortgage insurance premiums and limited loan amounts that come with FHA loans. Make sure to weigh the pros and cons carefully before deciding if an FHA loan is right for you.